Contents:

We like to provide more leeway for my https://traderoom.info/s, just in case price retests the bottom or top. The ‘noise of the market’ implies that all stop losses are to some degree vulnerable to being triggered before price makes a sustainable one directional movement. If you plan to enter the market at the Fib level of 38.2%, then you will place a stop loss beyond the level of 50.0%. Just as important as knowing where to enter the market or take profit, knowing where to place a stop loss is also crucial. It forms in the spaces where ask is higher than bid while the price doesn’t fall beneath this level and keeps bouncing back up off of it.

Fibonacci extensions are very useful for determining exit positions when the price breaks out of the trend, beyond 100%. To obtain the ratios for Fibonacci extension vs retracement, we simply add the usual ratios to 100%, which gives us 1.236, 1.382, 1.5, 1.618, and so forth. Finally, we get to the meat of our article, where we teach you about Fibonacci trading strategy. Below, we go through various Fibonacci retracement trading strategies that you can use as your Fibonacci day trading strategies for making reliable market entries and exits. Keep in mind that there’s no single best Fibonacci trading strategy, as each one can be applied in different circumstances. If you are still wondering how to place Fibonacci retracement you are in for a treat.

In the opposite direction, when the price is in a downtrend and you’re in a short position, you can place a stop loss just above the Swing High which acts as a potential resistance level. Generally, we can say that many traders use Fibonacci ratios to determine where and when to enter a currency pair position. The Fibonacci number sequence and golden ratio is used by many savvy traders today so let’s look at how they can make huge profits in ANY financial markets. To make the best use of the indicator, you need to use it in conjunction with other trading strategies as well.

- Placing the entry order behind the level has not make a lot of sense.

- The price retraced all the way back and tested the 38.2 mark for quite a while before hitting the trend line and continuing to go to the upside.

- The bottom line is that you can’t necessarily depend on those Fibonacci sequence numbers because they’re not as “golden” as you think — the market goes where it wants to go.

- A strong trade signal is one that is confirmed by more than one indicator.

- At one time, the AUDUSD downtrend offered an interesting chart to search for short setups.

- Fibonacci numbers are useful but should be used as part of a trading plan.

Intraday traders monitor hourly charts throughout the day to avoid any short-term reversals in the Forex market. Scalpers and market timers prefer using 15-minute charts and monthly charts together to find the proper Fibonacci retracements levels. If you want to buy near the 50% retracement level, place your stop-loss order right below the 61.8% retracement level to maximise profits and minimise losses.

What is the Fibonacci sequence?

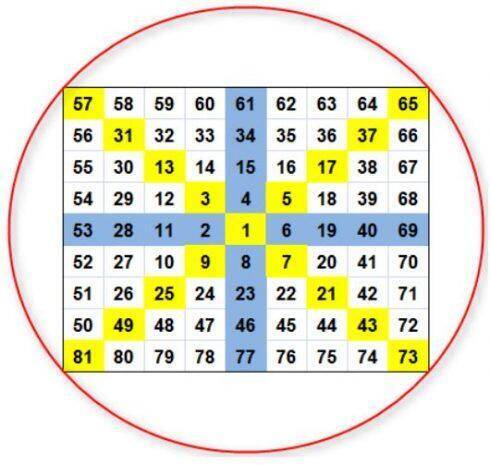

The first and second points are placed at the beginning and end of the first wave of an uptrend. The third point is placed at the end of the correction, the chart is stretched to the right. Correction levels show the probability and depth of the corrective movement in the range from 0% to 100%, where the two points of 0% and 100% are the extremes of the current trend.

So at this point, you have two trades on, both in profit. In a SELL-In order to make your entry, you will wait for the price to close below either the 38.2% or 50% line. In a BUY-In order to make your entry, you will wait for the price to close above either the 38.2% or 50% line. And the 38.2, 50, 61.8 lines have all been proven to be the best retracement lines to use with the Fibonacci. Because we need the price moves to hit our trend line, stall, and go back in the direction of the trend. Trend lines are a key component of trading and I always recommend using them when you can.

As you might know, the Fibonacci tool is a very valuable indicator for spotting support and resistance but the indicator can also be used for trading decisions. Fibonacci retracement is a method of technical analysis that is based on the Fibonacci number sequence. The retracement expresses important proportions of this number series. These ratios are derived by dividing the number in the Fibonacci sequence by the number immediately following it.

How Does Fibonacci Retracement Work?

The problem with this method of setting stops is that it is completely dependent on you having the perfect entry. Keeping that in mind, below we show you two methods to use the Fibonacci retracement tool in order to effectively place stop-loss orders. The problem with this method of setting stops is that it is entirely dependent on you having a perfect entry.

If you see a candlestick reaction at the Fibonacci level, then using a stop loss below the candle low or above the candle high could be a valid approach. Stop losses just beyond a strong Fibonacci level can work out fine and offer better reward to risk ratios. The key element is to have sufficient confluence on the charts at that particular level.

RSI Indicator: How to Use, Best Settings, Buy and Sell Signals

They are more suitable for intraday strategies with relatively little profit. They serve to predict a long-term trend in relation to the current trend highs and do not take into account local corrections. Pauses occur in a downward or upward move, after which the price pulls back or pushes forward to the level of the previous pause.

This helps in provide traders with the early entry points that help save them from major breakouts and breakdowns in the foreign exchange market. Moving averages are useful for identifying potential support and resistance areas. This point is a great place to enter the market or take the profits. Despite their unexplainable nature, Fibonacci retracement levels are considered a reliable tool for price movement prediction, especially coupled with other technical analysis methods.

Navin Fluorine, Union Bank & AB Capital among 5 stocks that may rise in near term – Business Today

Navin Fluorine, Union Bank & AB Capital among 5 stocks that may rise in near term.

Posted: Tue, 18 Apr 2023 07:07:53 GMT [source]

Corrective levels are plotted only on one trend wave based on two points from the beginning of the trend to its current high. The extension of Fibonacci retracement levels is plotted based on two points waves – three points coinciding with the beginning of the Elliott waves. The basic rule is to set a stop loss near the next closest level.

Fibonacci retracement with other tools

You can use calculators that calculate intermediate fibonacci stop loss based on the input of price extremes. I will show you how they work through a couple of examples. Fibonacci retracement levels closest to the opening point of the trade are the take-profit target.

If market has not reached it for some pips, usually it return later and hit it. I feel uncomfortable to enter short, if some Fib target just above me. For instance, assume that this price action on the pictures above happens on an hourly chart and the reason, i.e. the major signal why you want to sell lays on daily time frame. Then, possibly it is better to place stops past the extremes – this will allow the market room to breathe in the higher time frame structure.

HDFC, RK Forgings, DLF & HG Infra: Axis Securities’ 4 picks that can rally up to 18% in a month – Business Today

HDFC, RK Forgings, DLF & HG Infra: Axis Securities’ 4 picks that can rally up to 18% in a month.

Posted: Mon, 10 Apr 2023 07:00:00 GMT [source]

This is why it’s important to combine the Fibonacci Retracement with other technical indicators; doing so will help to confirm the signals produced by the Fibonacci Retracement tool. An example of this would be to combine the Fibonacci Retracement with candlestick patterns. For example, if you buy when the price retraces to the 61.8% Fibonacci level and there is a bullish engulfing candlestick pattern, this would be considered a confirmation signal.

To give you a better idea, a ratio of 34 divided by 55 is approximately 0.618, which is the basis for the 61.8% Fibonacci retracement level. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.76.20 % of retail investors lose their capital when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

AxiTrader Limited is amember of The Financial Commission, an international organization engaged in theresolution of disputes within the financial services industry in the Forex market. When acquiring our derivative products you have no entitlement, right or obligation to the underlying financial asset. AxiTrader is not a financial adviser and all services are provided on an execution only basis.

Determining Stop Loss with Fibonacci

If the price action confirms the levels, traders may enter positions or adjust existing positions accordingly. Investors use Fibonacci projections as a complementary tool along with other technical analysis indicators and fundamental analysis to make informed decisions about their investments. The bottom or top of the Fibonacci level is where the trade and analysis is invalidated because Fib traders will only place the Fib tool on an appropriate/sturdy swing.

Waiting for confirmation triggers means that we are waiting for the price to reach my desired Fibonacci level but I am not entering when the price reaches the Fib. Instead, I am waiting for the price to react to the Fibonacci level before taking an entry. The best reaction is a candlestick confirmation at the expected Fib level.

By setting a profit target at this level, traders can take advantage of this resistance and exit their positions profitably. What follows is a basic trading strategy using exactly the same Fibonacci technical indicator shown previously. A technical analysis tool that traders use to identify potential support and resistance levels in technical analysis. This tool is based on the idea that prices will often repeat a predictable portion of a move, after which they will continue to move in the original direction.

This helpful tactic has a high rate of ensuring a decent entry at the right time. Fibonacci time ratios explain how long a swing high swing low might take in time before the next swing high swing low starts. It does that by measuring a completed swing high swing low and then placing 38.2%, 61.8%, 100% of the time length forward. The next swing high swing low has a higher chance of finishing at these Fib levels. Interestingly enough, Fibonacci sequence numbers tend to do pretty well as guidance on how far a thrust or impulsive move can last in a number of pips. Of course, the lower frames will adhere to lower Fib numbers, whereas higher time frames to higher Fib sequence levels.

USD/JPY forecast as Japan inflation slips, manufacturing improves – Invezz

USD/JPY forecast as Japan inflation slips, manufacturing improves.

Posted: Fri, 24 Mar 2023 07:00:00 GMT [source]

The last factor to consider before using Fibonacci Retracement is the support and resistance levels of the market. This is because Fibonacci Retracement can be used to identify potential support and resistance levels. As such, you should consider this when placing your trade orders. With this basic trading strategy, only Fibonacci retracements were used.

This means that we can’t be talking about the changing direction yet. Price is the calculated price, A is 0% price , B is 100% price , Level is the Fibonacci retracement level. If the main price pulls strong, the correction will end here with the highest probability. The grid is stretched from the beginning of the trend to its end.

This is an important method to improve one’s Fib trading when you are just starting out with Fibs. This is one of the most used indicators in technical analysis, which even professional traders cannot afford to use. In this article, we will tell you how to use the Fibonacci retracement to increase your chances of making a profit in trading.